Pick a Winner

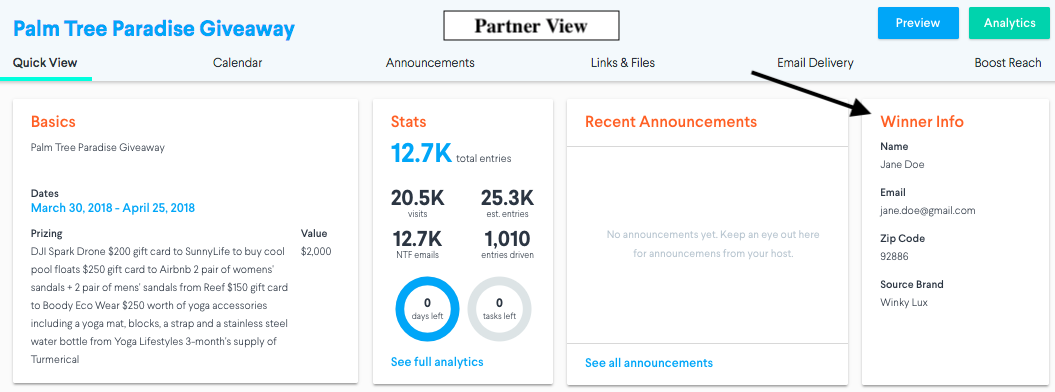

After the campaign ends, the host will pick the winner using DojoMojo's automated generator that will randomly select one email from all entrants. Once the winner is selected, the partners will be able to see their information in the Quick View (see below).

1. Navigate to Pick a Winner

In order to pick a winner, the campaign must already have ended. If you want to end the giveaway before it is set to close (and you have notified your partners of this early closing) you can go to Quick View > Actions > End Campaign.

Once your campaign has ended, you will be prompted to pick a winner. You can do so by going to your Quick View > Actions > Pick Winner

2. Notify Winner

Once a winner has been selected, the host will notify the winner in an email. The host will ask the winner to sign an affidavit, provide with a 1099-MISC tax form (see below), and ask for a photo ID. If the winner does not accept the prize within 7 business days, the host can pick a new winner. Our best practices state that the host will let winner 1 know that they have not responded in time and that a new winner will be selected, effective immediately. The host is only required to pick 3 winners. If all three either do not respond or decline the prize, then no winner is selected for the giveaway.

3. Notify Partners

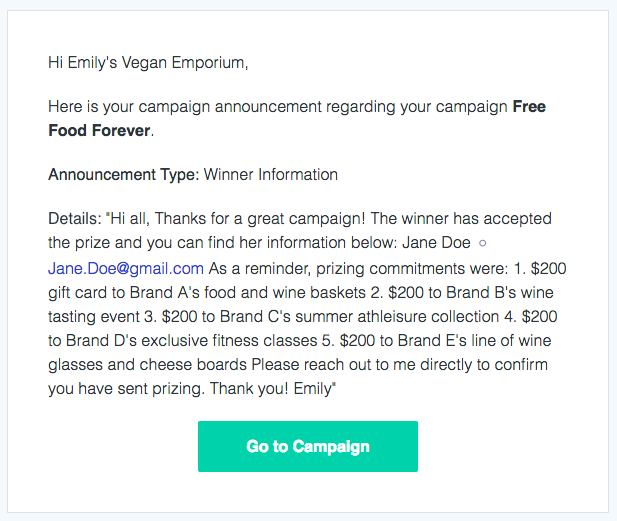

After the winner accepts the prize and provides the host with the signed affidavit and photo ID, then the host can notify the partners. In the Campaign Announcements, the host can let all partners know the winner has been selected and accepted the prize.

We recommend that the host provides the winner's information in the campaign announcement section as well as all prizing commitments (which can be easily copied from the rules section). Here is an example:

We recommend that the host provides the winner's information in the campaign announcement section as well as all prizing commitments (which can be easily copied from the rules section). Here is an example:

The partners will also have access to the winner's information in their Quick View (see screenshot above). The host should ask each partner to confirm when prizing has been sent. This way, the host will have written confirmation of fulfilled commitments should there be any questions in the future.

Affidavit and Liability of Release Forms

An Affidavit of Eligibility legally certifies that the winner is eligible to win.

An affidavit is a legal document that contains a statement (sworn in writing) that verifies one’s own personal information, such as name, age, and SSN. It is a verification of identity, which, in turn, is an verification of eligibility.

The Affidavit of Eligibility document affirms that the prize winner has read and understood the Official Rules of the giveaway campaign. It also assures that the sponsor brand is free of any liability after transferring the prize.

If your prize value exceeds $600, you’ll also need to issue an IRS 1099 form to the winner, so make sure your Affidavit of Eligibility asks for their Social Security number. Consult a lawyer to get an Affidavit of Eligibility and visit the IRS website for a 1099 form.

A Liability Release form gives giveaway sponsors the right to use and publish information about the winner. It also releases the sponsors from any liability that might arise in connection to the giveaway. Consult a lawyer to get this release form.

What should host brands do?

Ask the winner to read, agree to, sign, and return the affidavit, along with clear scans of the front of their government-issued ID (driver’s license or passport). The only info that needs to be visible is birth date and address, so the potential winner can block out the other information if they want. Alternatively, the winner can have the affidavit notarized, and an ID copy is not required.

The affidavit verifies that:

- The information entered on the giveaway entry form is true and accurate.

- The potential winner is in compliance with the rules - they are eligible to win the prize and are not associated with the giveaway’s sponsor.

- The potential winner agrees to the terms and restrictions of claiming the prize, if any.

The affidavit may also ask to confirm that the sponsors can publish the winner’s name for publicity purposes. Based on the terms of the affidavit, the potential winner can decide whether to accept the terms or decline the prize. If the prize is for two or more people, all guests of the potential winner must meet the same eligibility requirements and submit a guest release, which verifies the same information as the affidavit.

Notarizing an Affidavit

Affidavits must often be witnessed by someone authorized to verify the information, such as a notary public. A notary provides an additional level of security by acting as an impartial third party who is authorized to double-check that the winner is who they say they are. If the affidavit is notarized, you don’t need the government-issued ID.

- Example Affidavit (Note that DojoMojo and Innovation Brands Corp. cannot be held liable if you use this sample language): http://assets.dojomojo.com/uploads/2018/02/01151544/Affidavit-of-Eligibility-and-Release-of-Liability.pdf

1099-MISC Form

What is an 1099-MISC form?

The 1099-MISC form is used to report miscellaneous payments to non-employees. Any giveaway prizes are considered to be miscellaneous payments. The form will include information that helps keep track of the income received by winning the giveaway, so that the potential winner can report it accurately to the IRS at tax time.

The form will include:

- The sponsor’s name, address, and tax ID number

- The reported value of the prize

- The winner’s name, address, and SSN

- The tax year that the 1099 form applies to

- Other relevant info

If the winner lives in the United States, they will be paying taxes on their prizes when their prize is worth more than $600 or if they were asked to fill out an affidavit to receive the prizes.

Partner Responsibilities

Any participating brand (host brand or joined brand) is required to send a 1099-MISC with their tax information on it if the Market Value of the prize that they are individually contributing to the winner is over $600. According to the IRS guidelines, brands must mail a copy of the 1099-MISC form to giveaway winners in a letter postmarked by January 31 of the year following the year in which they receive the prize. The 1099-MISC form should be for the year in which the winner actually received the prize, so if a large prize is not delivered until a year after a giveaway, the form will be sent by the end of January of the year after that. You don’t have to wait until January - you can send it shortly after awarding the prize.

For compliance and as a best practice, the host brand of any giveaway should send a blank 1099-MISC form to the winner in case other brands who have contributed over $600 in prize don’t send their own. Even if every brand participating in a giveaway is each contributing under $600 and therefore does not need to send individual 1099-MISC forms, if the total value of the prize exceeds $600, it must be reported as miscellaneous income to the IRS.

Once you’ve sent the form, it’s up to the winner to fill it out and report their prize in their taxes. They only have to fill it out for the prizes they actually received. A sample 1099-MISC form and instructions for using them can be found on the IRS website: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf

1099-MISC for Guest

If the prize involves an experience “for two” (rather than simply cash credit for a second guest), the winner’s guest must also be eligible and would have to fill out a 1099-MISC, too

Note: At DojoMojo, we are not lawyers and this article shouldn’t be taken as legal advice. Some states have additional requirements according to prize value. Always consult with a knowledgeable tax professional if you are unsure about anything to do with your sweepstakes taxes. Tax laws change frequently, and the most recent information can be found on the IRS website. It is always best to consult legal advice if you have the resources to.